Financial Markets are Complex

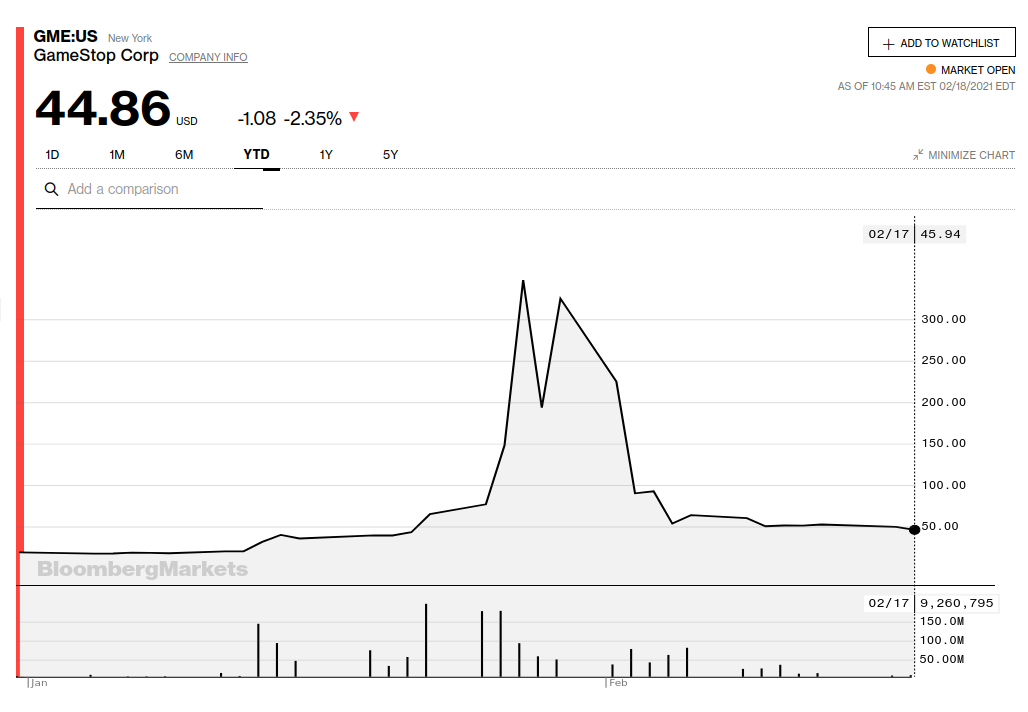

18 Feb 2021 complexity · gamestop · stock-marketThe Gamestop stock started 2021 at a modest $17.25. It then went up to $347.51 on 27th January. It went back down to $53.50 on 4th February. It closed on February 17th at $45.94, about 2.66 times it’s price at the start of the year. Millions of words and thousands of column inches have been devoted to explaining what happened, why it happened, and who was hurt. I wanted to write about a few peculiar things I noticed in the past few days that were the bizarre side shows to the main event: politicians (and Elon Musk) posturing for publicity by saying things about other things that they know nothing about, truth not prevailing no matter how much effort is spent on explanation, general disapproval of complexity in a system and societal conviction that the stock market is “rigged”.

Politicians posturing for publicity

Politicians in the US tweeted about this and claimed to fight for the “little guy” and question Robinhood. Surprisingly (for me), they didn’t do their homework and were caught saying things that made little sense. Elizabeth Warren was a notable exception and no wonder; a veteran policy maker with deep knowledge of the stock market, she made a very good case in her letter to the SEC. Elon Musk is not a politician, but his posturing for publicity is no different from other politicians, and he was able to fuel the mania effectively.

This might not come as a surprise to some readers. Politicians say outrageous things because it gets them air time. Reality shows are a close parallel that might help us understand this phenomenon and teach us how to correct our reaction for this “posturing bias”. Indian reality shows like Splitsvilla and Roadies often have contestants whining about another contestant “grabbing footage”. These reality shows are inspired by American reality shows like The Bachelor and Roadies USA. The motivation for most people who go on these shows is to become famous or to make it in the Indian film industry. Their most effective way of doing that is by doing something outrageous and getting noticed by producers and casting directors who are skimming through thousands of portfolios to find the person who will play the lead or supporting role in their next venture. These shows are notoriously bad at turning contestants into actors: The only person who can be considered a success for the Roadies => Film industry path was Ayushmann Khurana, in the more than nearly 15 years that these shows have been running on television. This low success rate has dampened the popularity of these shows, but they continue to live on as zombie versions of their old popular selves.

One of the effective strategies to correct for posturing bias can be seen in action in reality shows, when other contestants wake up to the footage grabbing behavior of one of their co-contestants and begin to isolate them from their plotting. This inevitably leads to a loud showdown between various factions of contestants and ends with some people getting “eliminated” from the show. Now, irrespective of whether the footage-grabbing contestant left the show, this sudden blow-up changes the dynamics and the group re-aligns around some other contestant. As a viewer, this is a great “reset point”.

We can apply this strategy to politicians: tune out their opinions and look at their past actions. This is hard to do because the number of mediums that politicians can use to reach people has grown exponentially; talking heads on TV can talk about any subject for hours on end because there is no real expertise that is required for their job and their lack of such expertise allows them to talk with unflinching confidence even when they know nothing about the topic. Most media coverage does not cover what politicians did, rather preferring to cover the process that they were using or what groups they are aligned with or what their latest speech said.

So, if one wants to figure out what a politician actually did, one really has to dig into their legislative record. Personally, I have found this process of digging around to find out how a politician has performed to be rewarding as it has helped clear up my misguided beliefs. (E.g. Since Kejriwal got elected as the Chief minister of Delhi about 5 years ago, I was a staunch believer that he was an ineffective leader and that he had failed the people of Delhi. I believed this without any evidence or lived experience. When he won re-election, I was forced to challenge my views. This lead to the discovery that I had been completely wrong in my belief)

The process of researching the politicians past actions and figuring out how much of what they talk about has turned into action is time consuming and requires you to break down some of the internal barriers that give information that is learned earlier more importance that information that is added later on. Nevertheless, this is an effective method to reject propaganda and attention-seeking statements.

Truth does not “eventually” prevail

Contrary to popular belief that truth will eventually prevail, the past 5 years have been proof that that is not a feature of the world that we now inhabit. With respect to GameStop, this was clearly in the information about clearing houses demanding collateral from Robinhood not getting through to anyone, even people who were closely tracking the developments. When the mania started to die down and politicians shifted into their “posture by claiming to do something” mode, contention started going around about payment for order flow and what it meant. Everyone disregarded the explanation that people who had worked in the financial markets were trying to communicate to others and instead started rallying against it, despite it being the reason that brokers like Robinhood were able to give trading services at 0 trading fee to their users.

This problem is harder to effectively solve; while one might be tempted to offer up “Do your own research” as a strategy, I am skeptical that the truth can actually prevail when we are talking about binary representations (truth/lie) of complex situations. Particularly, depending on the case, the two situations could be so close to each other that it is hard for a rational observer to parse the facts and reach the same conclusion every single time. 13 years removed from the Economic crisis of 2008, we can say with a fair amount of certainty that the folks at Standard & Poor were not rating the financial instruments they were seeing fairly. But this is simply one piece of the puzzle; within the complexity of the financial system, several other players and forces are hidden and one person would not be able to understand the full scope despite spending unreasonable amounts of time reading / researching the topic.

Although, that is not to say that I am defeatist on this. The strategy that I have found useful is to limit your media diet: Focus on secondary sources that you trust as sources of verifiable information and depend on primary sources as sources of detailed information about the topic. E.g. News reports on Bloomberg would be sources of verifiable information about the state of the economy in a given country, but if I wanted to find out about unemployment or the reasons for unemployment in a particular sector of the economy, I would have to read research papers, surveys and government reports which can be considered primary sources because they are much closer to reality than News reports.

General disapproval of complexity

Occam’s razor provides an articulate argument for rejecting complexity:

Among competing hypotheses that predict equally well, the one with the fewest assumptions should be selected – https://github.com/icyflame/awesome-social-science#occams-razor

At my day job as a software engineer, I eschew complexity at every step along the way. I have heard that this is a good principle when designing large, distributed systems which tend to have several points of failure and an increase in complexity compounds the various causes of failure and prevents effective investigation, despite one’s certainty that there is a problem that needs to be fixed.

Fortunately, the real world is not a software engineering design problem. There is no limit to the complexity that can be attained with fairly simple systems whose dynamics are linear and well understood in some cases, but can quickly become non-linear and chaotic (E.g. pendulums that enter a chaotic state when the forcing frequency is slightly different from the natural frequency). So, one of the contracts that we must maintain with the real world is the active acceptance of complexity in the systems that we interact with: bureaucracies, economy, healthcare, education. All of these systems includes hundreds of thousands of people and to expect any of those systems to be something that can be explained in a news article, YouTube video, or book is irrational.

The Gamestop episode has shown that complexity is not palatable to most people. In particular, the minority of minds that are vulnerable to conspiracy theories look at the workings of a complex system, that is way beyond the comprehension of a single person and see a vast conspiracy that is making the system do things that it was not “meant” to do (like a large bureaucracy with intertwined departments). Admittedly, they have little evidence about what the conspiracy is or who is pulling the levers, but they have a convenient and rational escape for this line of reasoning: The system itself is keeping the “truth” from observers because it is in the system’s interest to do so. Once the initial threshold of irrationality is crossed, the line of reasoning becomes rational and easy to accept.

Once again, this problem is hard to solve, even on a personal level. I am not sure how to correct for this anti-complexity bias when the problem is known to be complex (E.g. Global warming). The urge to assign blame to invisible sources is quite high and everyone has to struggle with the uncomfortable state of accepting that a system that one is participating in is beyond one’s comprehension or accepting the “simpler” solution of a conspiracy that explains the complexity as an orchestrated illusion. I advocate for the former.

Conviction that the market is “rigged”

This amazing quote from a recent article perfectly summarizes this conviction:

“It’s another episode similar to those past ones of the public feeling like there are multiple things wrong here — not really knowing what is exactly wrong, but just feeling like something is not working. It’s just a general popular sense that a system wherein this kind of scenario can come to pass, just fundamentally doesn’t work for the public and it is ‘rigged,’ or something else, but they know something is wrong.”

– Graham Steele, senior fellow at the American Economic Liberties Project – https://www.businessinsider.com/reddit-wallstreetbets-traders-failed-war-wall-street-proves-system-rigged-2021-2?amp

What happened with Gamestop is a variation of the widely known “pump-and-dump” scheme: People buy a stock they know is worthless, pushing it’s price to a value that doesn’t make any fundamental sense. In a classic pump-and-dump scheme, the people who pushed the value up will dump the stock at a peak point that they pick. In this scheme, most of the buyers have held on to their stock. Their reasons seem to be a mix of “It was fun and I wanted to be a part of it”, “It’s like gambling. Also, YOLO (You Only Live Once)” and “I get Reddit Karma when I post a photo that shows losses”. Putting that aside for a bit, what happened with Gamestop is not a revolutionary insight into market operation. It is a mundane methodology which can be used to push the price of any instrument up (Musk is at it with BTC: BTC is at a new all-time high, again).

That said, now, what is the argument behind the “market is rigged” thesis? As far as I can tell, it is a variation of the argument that retail investors are not as good at making money as institutional investors. Colloquially known as “the house always wins”. I don’t think this is true. I will analyze it from two points of view: Process and Resources.

Process: Retail investors, who have money that they want to invest into the stock market, can invest just as institutional investors do. Buffett’s principle of “Value Investing” is one theory of doing that: One can look at a public company’s financial reports, recent news, governance structures etc and decide whether one wants to invest in it. The process is not different for institutional and retail investors. Now, retail investors are unable to do some things like “shorting a stock” or purchasing government bonds from foreign governments directly. But these are mostly related to a particular instrument and not a feature of the market itself (i.e. Institutions don’t want to let retail investors short stock because if the retail investor doesn’t pay or is unable to pay to buy the stock back at a later date, the institutional investor will be on the hook for this money).

Resources: Institutional investors have a major advantage at buying and selling on the stock market: It is their job. People who work at investment banks and hedge funds have spent several years understanding how markets work and how to turn a profit using that knowledge. To begrudge them their expertise seems unwise and petty. In terms of resources, they clearly beat the retail investor: A retail investor clearly has less time and they have much less money to take the risky bets that institutional investors can sustain. I don’t think this is anything even close to the market being rigged. In fact, it simply points to the fact that the market rewards expertise and that capitalism rewards capital.

For most retail investors, the suggested investment strategy is to invest in “Index funds”. Now, considering that most normal people will do something like that, I think the “market is rigged against normal people” thesis loses even more ground because it is rarely in the interest of average investors to pick individual stocks and invest in them, rather than investing in Index funds (Not investment advice).

(A useful example for this might be to ask yourself if something else is rigged, by this same logic. For e.g. Someone who wants to play Tennis or Golf will have a big advantage if their parents have the time and money to go to various tournaments, hire a good coach, buy the right equipment, regularly drive them to practice sessions and so on, their chances of success at the sport go up exponentially. Does this mean that the sport is rigged against people who don’t have these resources? In my opinion, the answer is YES; I just don’t feel as strongly about leveling that playing field as strongly as I feel about something like poverty in various countries.

I would like to end this analysis of the various players in the landscape today with a quote from the journalist Matt Levine. His newsletter “Money Stuff” has been an incredibly valuable resource as I have tried to understand what really happened, and why it is only history repeating itself and not some unprecedented event.

I don’t think, however many days we are into this nonsense, that GameStop is a particularly important story (though of course it’s a fun one!), or that it points to any deep problems in the financial markets. There have been bubbles, and corners, and short squeezes, and pump-and-dumps before. It happens; stuff goes up and then it goes down; prices are irrational for a while; financial capitalism survives.

– Matt Levine, the “Money Stuff” newsletter – https://www.bloomberg.com/opinion/articles/2021-02-01/gamestop-gme-is-old-news-after-reddit-discovers-silver-futures

P.S. 1: One of the articles linked above is a dailymail.co.uk article. I couldn’t find a similar article on other websites so I decided to bite the bullet and link an archived version of that article. If possible, you should ignore the bar on the right side on that page or consider opening the page in the Reader mode on your browser. (Daily Mail is a gossip website, similar to TMZ)